Your Guide to the HomeBuilder HomeRenovator Grant

The government’s new HomeBuilder program has received its fair share of backlash, with many industry experts blasting the “very restrictive” rule on needing to spend $150,000 more on a renovation to be entitled for the $25,000 grant.But despite the criticism, more than 12,000 Australians have flocked to the Treasury’s website to register interest in the scheme a week aft...

How To Apply For The $25,000 HomeBuilder Grant in Queensland

The government’s new HomeBuilder program has received its fair share of backlash, with many industry experts blasting the “very restrictive” rule on needing to spend $150,000 more on a renovation to be entitled for the $25,000 grant.But despite the criticism, more than 12,000 Australians have flocked to the Treasury’s website to register interest in the scheme a week aft...

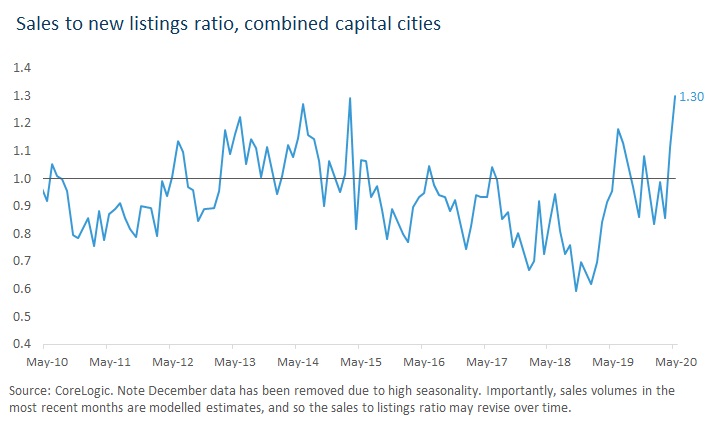

Buyer demand outweighing new May listings

A 0.3% decline in March GDP confirmed a technical recession is underway in Australia, total wages paid fell 5.4% between mid-March and early May, and Australian dwelling market values saw the first month-on-month decline since June 2019.But one surprising sign of stabilising emerged in May. Home sales have risen, with home owners testing the market, and new listings are...

First National Real Estate Announces State GEM Award Winners

The network’s inaugural Instagram Live awards event streamed video to members and engaged with them in real time as they opened their awards packs On Friday 22 May, First National Real Estate Coastal was recognised for outstanding achievement at the General Excellence and Marketing Awards, in a ground-breaking Instagram Live event, bringing together award recipients from each office arou...

Sunshine Coast landlord forced to discount rent after QCAT rules in favour of tenant

A Sunshine Coast landlord will be forced to discount the rent for his long-term tenants after the Queensland Civil and Administrative Tribunal ruled he could not prove reducing the rent would put him at a financial disadvantage. The ruling by Maroochydore QCAT is believed to be the first of its kind in Queensland using the temporary tenancy laws introduced to help renters struggling financiall...

Three of the Big Four banks now offering home loan cash backs

More than a dozen lenders are offering cash incentives for home owners willing to move their business to a new lender, with Suncorp Bank, Reduce Home Loans and 86 400 the latest, according to RateCity.Suncorp Bank is now offering up to $3,000 to refinancers, plus an additional $1,000 for people working in essential services roles, such as doctors, nurses, teachers and police officers.A total of...

How COVID-19 has impacted tourism hotspots

New research has revealed the impact COVID-19 restrictions have had on Queensland’s tourism property markets. The Palaszczuk government’s mandatory COVID-19 restrictions went live from 20 March 2020, with knock-on effects to the state’s property market.However, despite the perceived effects, the REIQ said the Sunshine Coast capital — Brisbane — has repor...

Property prices set to surge post-COVID-19

Investors are being reminded that the pain in the property market will be short-lived, with property prices expected to bounce back post-pandemic.Research conducted by PIPA chairman Peter Koulizos analysed annual median house price and index data for seven consecutive years, including the start of each recession or economic downturn from 1973 to the GFC. The data found that five years afte...

Which rental markets have been impacted most by COVID-19?

COVID-19 is having varied impacts on residential property, but arguably the biggest impact could be in the rental space.Prior to COVID-19, the Australian rental market was already weak. Now, new challenges are here. As Australian borders remain closed to tourists, and government policies restrict short-term rental arrangements, Airbnb rentals are converting to long-term rental supply....